Use Capital Campaign Planning Tools to Avoid Budget Nightmares

Capital Campaign Budgeting: How it Can Go Wrong

Back in 2011, our team worked with a private high school on what was budgeted to be a $7 million capital campaign to build a new student center. The feasibility study went great. The need for more space was evident, as were the benefits that the expansion would bring to the students and faculty. Equally promising was that donor prospects loved the school’s vision. Our team identified, educated and cultivated the donors and leaders that were needed, drafted a solid case for support, and devised a workable campaign plan. All the pieces were in place, so we moved forward into a capital campaign.

Then, right about the time we had our campaign materials (video, brochure, etc.) complete, the architect came to us with bad news. Our $7 million project was going to cost more like $15 million!

This is an extreme example of how capital campaign budgeting can go terribly wrong. I’ll come back to this story in a bit, but in the meantime, I want to show you how a few campaign planning tools can potentially help your nonprofit avoid budgeting nightmares.

Capital Campaign Timeline

The first tool is a simple table that anyone can create if you know when you want to start construction. Begin with your groundbreaking date and back up from there. In this example, a nonprofit wants to initiate construction on June 1, 2024.

If the nonprofit’s campaign total is $10 million, we can expect its campaign to last 18-24 months. Before the campaign can begin, a feasibility study should be done, which will take another 3-4 months. And before that, the nonprofit will usually want to go through a Request for Proposal (RFP) process which usually takes another 1-2 months. As you can see, there is considerable planning that needs to go into even the simplest question; when do we start with campaign planning (RFP, feasibility study) to hit our ground-breaking goal?

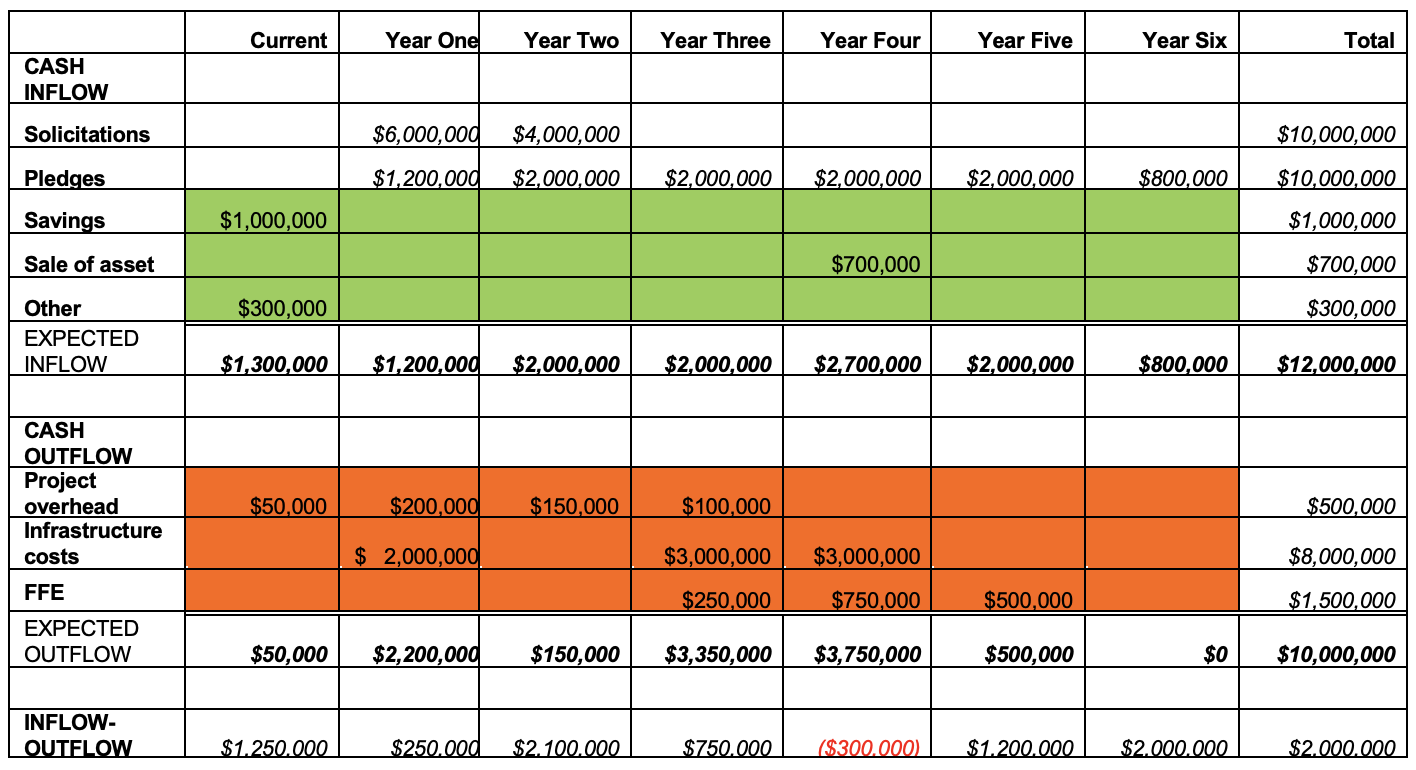

Capital Campaign Cash Flow Formula, Inflow

Now to the financial planning using our Capital Campaign Cash Flow Formula. Let’s assume that a nonprofit’s capital campaign goal is $10 million, and it has $1 million in savings (see “savings” row) that will go towards the project. Let’s further assume that its existing building, the one that is too small and will be sold, is worth approximately $700,000 (see “sale of asset” row) and that too will go towards the campaign total. Finally, the nonprofit already has pledges from its board totaling $300,000 (see “other” row) that will count towards the campaign. This is what the organization’s cash inflow (assets) will likely be:

In the row titled “solicitations,” we assume that it will take almost two years to make enough asks to secure pledges reaching the campaign goal. Sixty percent of that total will be pledged in year one, 40 percent in year two. The collection of those pledges can be found in the second row titled “pledges,” where we conservatively estimate that 20 percent of pledges will be collected each year over five years since the beginning of the pledge. Note that pledges often come in faster than 20 percent per year, especially large pledges at five figures or higher. We use 20 percent to be safe.

The bottom row shows the expected inflow of cash – how much money will the nonprofit have in the bank to pay people.

Capital Campaign Cash Flow Formula, Outflow

Now that we have a conservative cash inflow estimate, it is time to estimate the project’s cash outflow. We have a similar Excel table for that below.

The row titled “project overhead” includes campaign consulting fees and architecture fees. Below that, the row titled “infrastructure costs,” is the actual fees due to contractors for building materials and labor. The last row, “FFE,” stands for furniture, fixtures and equipment. It is one that many nonprofits forget to incorporate. It includes things like furniture, lighting and all the other items that are necessary to have a complete building, but not included in infrastructure costs.

If the nonprofit makes these cash outflow estimates when it should (i.e., 24-months before groundbreaking), then it will likely need help in estimating from outside experts. This is a great time to build board ownership and buy-in with the project. We encourage nonprofits to ask their board to go into the community and get good estimates on overhead, infrastructure and FFE costs from their friends, peers and neighbors. Remember, these are ballpark figures to help with planning. Nonprofits will have access to and direct knowledge of much better numbers once the fundraising begins because they will be contracted with the necessary parties.

Cash Flow Planning: What Does Your Unique Campaign Look Like?

Now it’s time to combine the inflow and outflow tables to see where we are with overall cash flow. The only trick to making sure we have good projections is the last row, “Inflow-Outflow.” It must take into account the current and past year’s positive or negative balance. In our example, the current year positive cash flow is found by subtracting the outflow of $50,000 from the inflow of $1,300,000 to give us $1,250,000. Moving to year one, we must account for the current balance and the year-one figures. While on its own, year one comes in at a negative balance of $1,000,000. Adding in the current balance brings the total to a positive $250,000.

Capital Campaign Cash Flow Planning: Dealing with Shortfalls

Based on our example’s figures, this project runs out of cash in year four. While this is disappointing, it would be much more disappointing if we didn’t know about the shortfall until year three! And now that we know of the shortfall, we can plan for it – assuming of course that the nonprofit does not have enough in reserves to cover the shortfall. Here are a few techniques that our team has found successful:

Speak to several banks about construction loans or lines of credit to use in year four. You may have heard these called “bridge” or “gap” loans.

Ask some major-gift donors if they can front-load their pledge and tell them why. This is when instead of spreading the pledge payments out evenly over five years, they pay more during the first few years.

Have a conversation with the contractor to see if payments can be spread out to coincide with your pledge redemption.

Now let’s return to my story about the school’s $7 million campaign that had jumped to $15 million. I will begin by stating that this nonprofit had its cashflow figured out for a $7 million project; their shortfall was not due to poor planning, but instead it was poor estimating by the architect.

What did we do? We began by going back to our major-gift prospects, the ones that would account for about 80 percent of the campaign total and had honest conversations with them about our predicament. Gratefully, all of them had personal experience with bad construction estimates. But their understanding did not cover our shortfall. They didn’t offer to double their gifts. The next steps we took were to find more donor prospects, speak to banks friendly to the school about loans and lines of credit, and work with the contractors about being flexible with their invoices.

All of these techniques worked because the school’s case for support was strong. People wanted to see them succeed, and they understood that the problems they faced were not due to poor planning but unavoidable circumstances.

Capital Campaign Planning Tools You Can Use

Would you like to use this cash flow formula for your own campaign planning? Download it now: Capital Campaign Cash Flow Formula. And check out our other Free Resources while you’re at it!

If you found this article useful, you might like to read Capital Campaign Gift Chart Builder Helps Nonprofits Focus on Process

Kevin Wallace is president of CampaignCounsel.org.